- Online retail sales – statistical data, consumer preferences

- Internet service and VAT rate

- Online cash registers – change of date

- Online cash registers – tax interpretations

- Digitalization and tax authorities

1. Online retail sales – statistical data, consumer preferences.

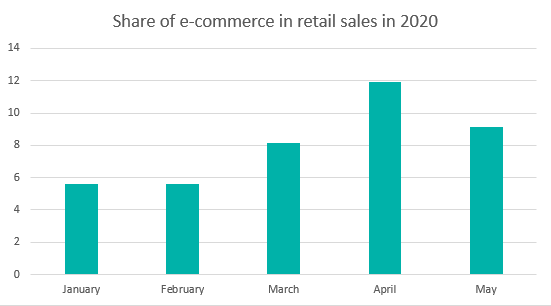

According to Statistics Poland, in April 2020 retail sales via the Internet (11.9%) almost doubled compared to January 2020 (5.6%). The increase in interest was due to changes resulting from the COVID-19 epidemic. Although in May 2020 a slight decrease was recorded (the share of sales via the Internet amounted to 9.1%), it is still at a fairly high level (compared to the period before the pandemic).

About 73% of Internet users shop online. This is an increase of over 10% compared to the previous year. Every third Internet user indicates that the reason for more frequent purchases over the Internet is coronavirus. However, not only the pandemic has accelerated the development of e-commerce. The availability of internet and mobile devices that allow online shopping makes e-commerce grow in strength. Only 3% of consumers with mobile devices do not use them for shopping purposes.[1]

The current situation has certainly significantly accelerated the development of e-commerce. According to the research of the Chamber of Electronic Economy, about 38% of respondents bought online during an epidemic. In addition, it should be noted that consumers made more purchases in order to create inventory for fear of quarantine.

When analyzing the consumer purchasing process, it should be noted that customers are more likely to use the Internet at the first stage of the purchase (i.e. searching for products, familiarizing with the range of stores and searching for specific items). However, they show a lower tendency to make a complaint or return a product via the Internet.

Given the growing importance of e-commerce these days, it is worth familiarizing yourself with tax issues related to this industry.

2. Internet service and VAT rate

Can a change in the way the service is provided from traditional to online service affect the VAT rate?

Due to restrictions on traffic and access to some facilities as a result of the COVID-19 epidemic, the ideal solution seems to be to transfer most services (if possible) to the Internet. If you can order clothes online, why not organize a theater performance online. This is the solution that has been implemented by many theaters. Theater performances attracted a lot of interest. Apparently the same service only via the Internet, but there is a fundamental difference – the VAT rate. In the case of selling tickets for a traditional theater performance (watching a performance in a theater), the VAT rate is 8% – Annex 3 of the VAT Act. However, when the show is viewed via the Internet, it is an internet service with a 23% VAT rate – art. 98 paragraph 2 of the VAT Directive stipulates that reduced rates do not apply to services provided electronically. Therefore, it should also be borne in mind that transferring your business to the Internet may also have an impact on tax aspects.

Here you will find Interpretation No. 5359 on the rate of VAT on theater tickets for online performances: http://www.sejm.gov.pl/sejm9.nsf/interpelacja.xsp?typ=INT&nr=5359

3. Online cash registers – change of date.

More time to introduce online cash registers thanks to the Regulation of the Ministry of Finance on extending the deadlines for keeping sales records using cash registers with electronic or paper copy recording (http://dziennikustaw.gov.pl/D2020000105901.pdf).

Pursuant to the Regulation, the deadline for taxpayers to keep sales records using cash registers with electronic or paper copying is extended:

- until December 31, 2020 for catering services and the sale of coal, briquettes and similar solid fuels intended for heating purposes – the date of commencement of keeping the records referred to in art. 145b paragraph 3 items 2 and 3 of the VAT Act were postponed to January 1, 2021,

- until June 30, 2021 for hairdressing, cosmetics, construction, legal and other services listed in the Regulation – the date of commencing keeping of records referred to in art. 145b paragraph 3 items 2 and 3 of the VAT Act were postponed to July 1, 2021.

Due to the fact that the Ministry of Finance estimates that 400,000 taxpayers will be obliged to exchange cash registers for online cash registers and in view of the current situation related to COVID-19, it was decided to postpone the deadline.

4. Online cash registers – tax interpretations

Article 145b para. 1 of the VAT Act indicates taxpayers who are required to exchange cash registers for online cash registers. However, when reading the rules, we are not always sure who should be change the cash register will be.

On 26th May 26, 2020, the Director of NRA issued an individual interpretation (reference number 0112-KDIL3.4012.262.2020.1.MŁ) regarding the obligation to use the online cash register from 1st July 2020. The considered issue was the obligation to replace the cash register with an electronic copy of the copy into an online cash register from 1st July 2020 in the scope of operation of the cinema shop. According to the applicant, he is not obliged to replace the cash register, as he does not run a typical catering establishment. The tax authority indicated that the cinema store in which, among others, popcorn, natchos, coffee, tea should be considered as a catering establishment, therefore the applicant’s position was found to be incorrect. Catering establishments can also be run in the area of hotels, motels, railway carriages and passenger ships.

5. Digitalization and tax authorities

Changes taking place nowadays are not only visible in companies (remote work) or customer preferences (greater willingness to shop online). Recently, public institutions also had to adapt their activities to the prevailing reality.

We have been able to file tax declarations or declarations online for a long time. Increasingly, it is possible to use the option of sending documents and contacting tax authorities via the e-PUAP platform. Recently, due to a pandemic, there have been many solutions to settle the matter in the office over the Internet instead of appearing in the institution in person. Examples of such solutions are:

- voluntary disclosure made by e-PUAP,

- receipt in electronic form after the buyer’s consent,

- a proposal of the e-Tax Office, i.e. an information and transaction system, thanks to which the taxpayer will be able to settle his tax matters online,

- the option of storing invoices in a digital form – individual interpretation of May 12, 2020, No. 0111-KDIB1-2.4010.103.2018.11.BG.

It should be noted that current times have meant that tax authorities are more likely to contact via the Internet, which is also good for entrepreneurs who, due to ongoing investments, were not always able to appear in person in the office.

In addition, it should be noted

that according to the signed Shield 4.0. it is possible to conduct e-hearing in

criminal matters.

[1] Report of the Chamber of Electronic Economy Omni-commerce